In the dynamic realm of cryptocurrency, Bitcoin’s halving phenomenon stands as a pivotal event that significantly influences its market value. Understanding Bitcoin halving is essential for both seasoned investors and newcomers eager to navigate the cryptocurrency market. This article delves into the essence of Bitcoin halving and its consequential impact on Bitcoin’s price, offering insights into why it’s a key driver in the cryptocurrency’s valuation.

Decoding Bitcoin Halving

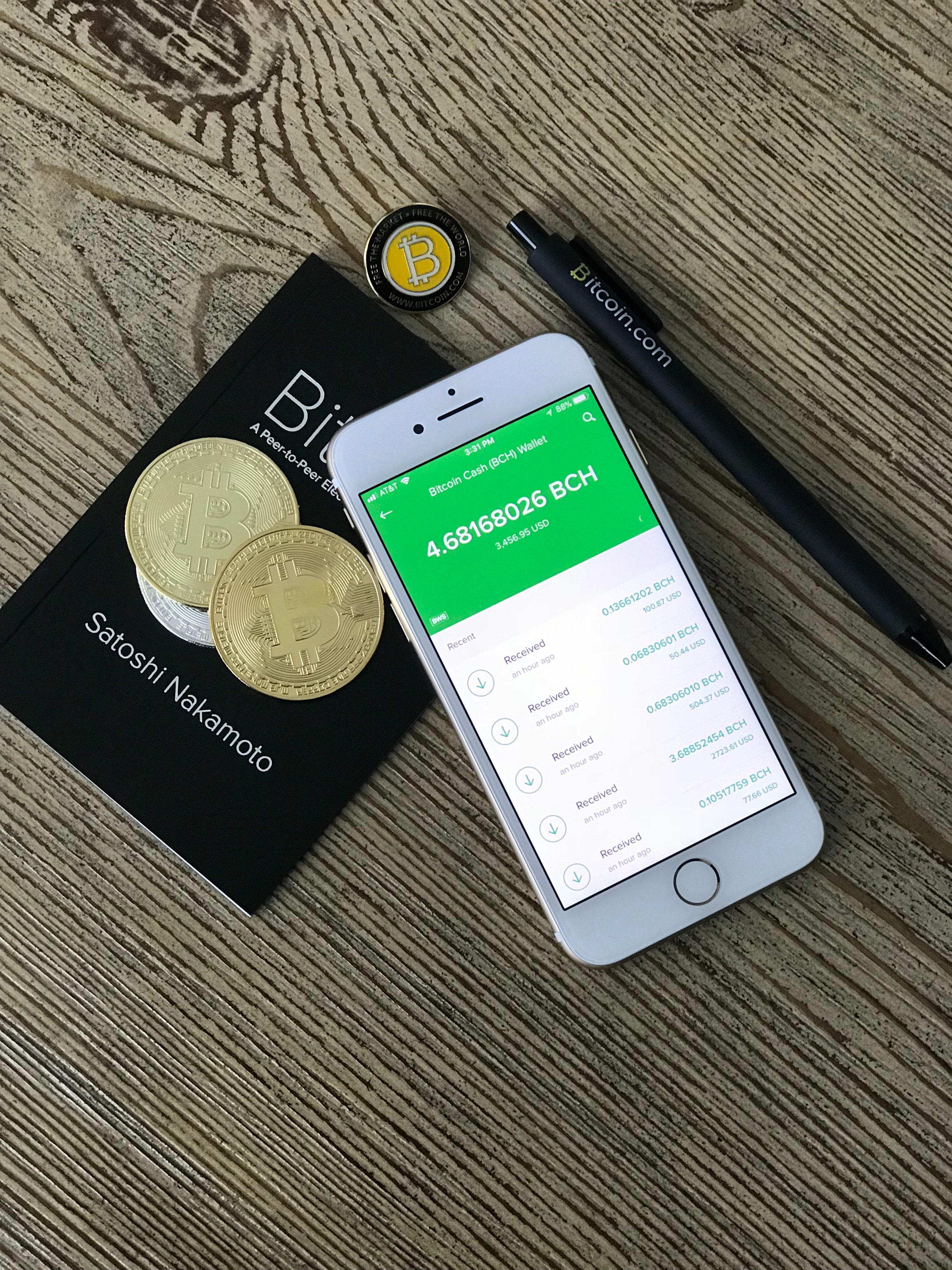

Bitcoin halving is a fundamental process embedded in the Bitcoin protocol, occurring approximately every four years. It effectively halves the reward for mining Bitcoin, thereby slowing the pace at which new Bitcoins are introduced into circulation. Originated by Bitcoin’s enigmatic creator, Satoshi Nakamoto, this process is designed to emulate the scarcity dynamics of precious commodities like gold.

Initially, miners received 50 Bitcoins per block, but post-halving, this reward diminishes by half, marking a significant milestone in the Bitcoin lifecycle. These events have historically led to a reduction in the inflation rate of Bitcoin, enhancing its scarcity.

Scarcity Drives Demand

At its core, Bitcoin halving boosts Bitcoin’s value through the economic principle of scarcity. As the creation of new Bitcoins decelerates, scarcity increases, potentially driving up demand if it outpaces supply. This scarcity mechanism is akin to that of rare metals, which become more valuable as they become rarer.

Halving’s Historical Impact on Bitcoin Price

Bitcoin halving events have consistently preceded substantial surges in Bitcoin’s price. This pattern stems from the reduced supply of new Bitcoins, heightening demand in a market where many anticipate value growth. Each halving event, notably those in 2012, 2016, and 2020, has sparked significant bullish trends in Bitcoin’s market price, underscoring the halving’s role in Bitcoin’s valuation.

Anticipation Amplifies Value

The anticipation surrounding halving events often leads to an uptick in Bitcoin purchases, as investors speculate on the halving’s impact on market value. This speculative buying can result in a pre-halving price increase, further fueled by the event’s scarcity effect.

Conclusion: Halving as a Market Catalyst

Bitcoin halving emerges as a critical mechanism, reinforcing the cryptocurrency’s scarcity and potential for value increase. By understanding the implications of Bitcoin halving, investors can better navigate the cryptocurrency market dynamics. The historical correlation between halving events and price increases highlights the significance of scarcity and demand in driving Bitcoin’s market value. As the cryptocurrency landscape evolves, Bitcoin halving remains a key event that attracts significant attention from the investment community, continuing to influence Bitcoin’s market trajectory.