Want to find out the impact of COVID-19 on the price and adoption of Bitcoin? If yes, then you have come just to the right place!

The COVID-19 pandemic has affected the financial markets throughout the globe, including the very well-known cryptocurrency market. Some experts suggest that post-COVID-19, cryptocurrency will experience a jump in adoption, while others are still concerned about how this pandemic will shape the Bitcoin market.

This article will enlighten you about how COVID-19 is impacting or may impact the price and adoption of Bitcoin. So fasten your seat belts, and let’s begin this exciting and informative session!

Why Bitcoin is Set to Boom after COVID-19 Pandemic?

With the looming global recession due to the recent pandemic, the purchasing power of cryptocurrencies was bound to be impacted. As COVID-19 is causing significant turbulence within the stock market, more people are eyeing towards investing in digital assets, including Bitcoin.

One of the primary reasons behind this booming prediction might be that digital assets usually have the potential to disrupt the global market and industries. As a result, the economic impact of the COVID-19 pandemic has caused a thorough increase in digital assets adoption, most prominently of Bitcoin (BTC).

The increasing interest of the global economy in Bitcoin during the COVID-19 situation can be judged from the fact that in early February, Google witnessed a 33 percent surge in Bitcoin-related searches. This reflects that more people are looking for alternative solutions within a bank controlled economy.

All in all, out of all offered digital assets, we believe that 2020 might be Bitcoin’s year considering the impending boom in the adoption of digital assets throughout the world. We are saying this because research suggests that during COVID-19, people started buying an increasing number of Bitcoins. Since the global market was going down initially due to the situation of COVID-19, the prices of Bitcoin went low, and many potential investors saw this decrement in price as a significant opportunity for Bitcoin investment.

How COVID-19 has Impacted or may Impact Bitcoin Adoption

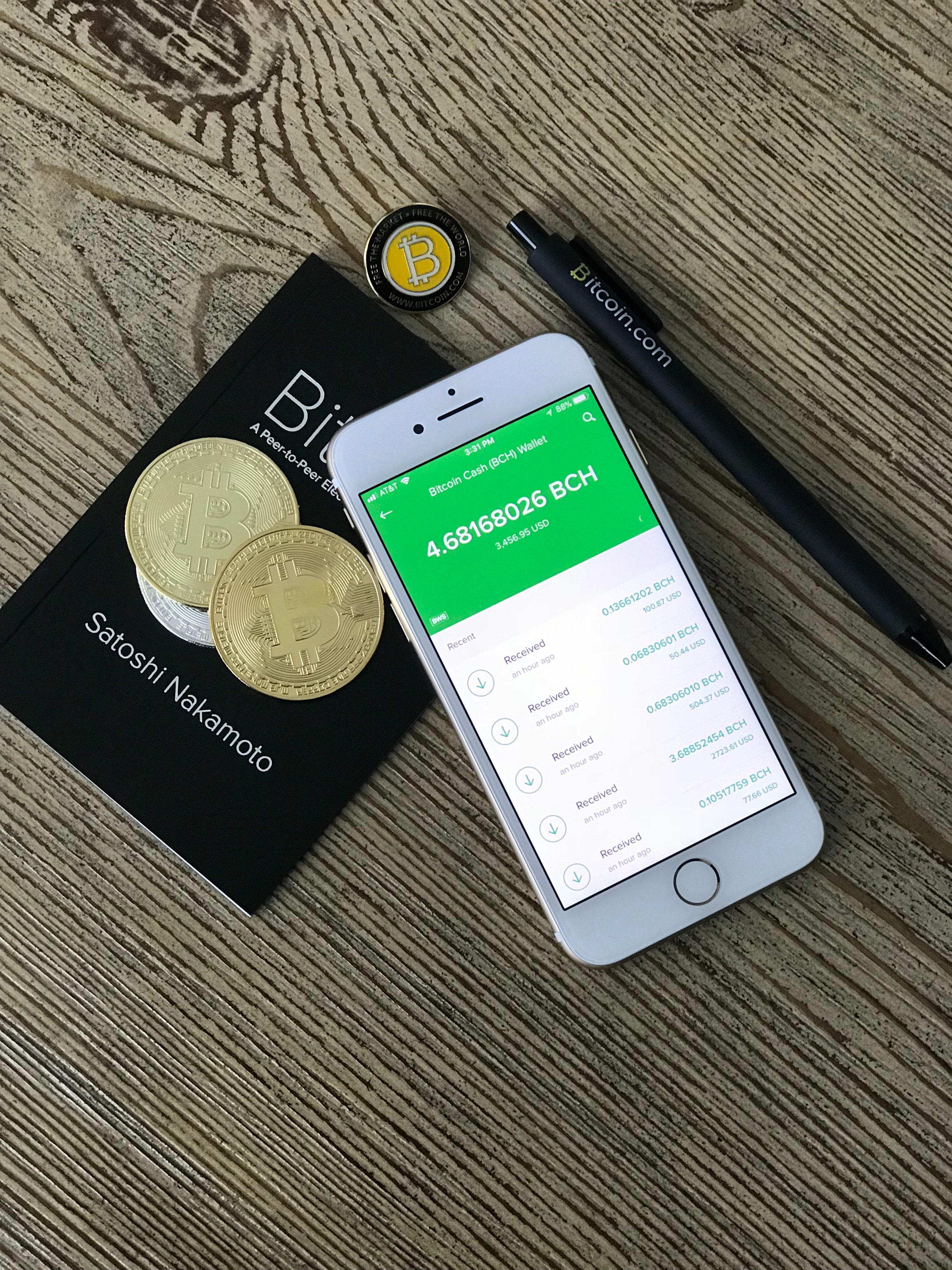

Many people agree with the perception that Bitcoin is just like digital gold – an asset in which you can perform investment during difficult times, such as the current COVID-19 pandemic.

It has been found out that the adoption situation of Bitcoin during the initial period of COVID-19 was quite unfortunate, because, on March 12, Bitcoin currency lost over 40 percent of its value.

However, with time, Bitcoin was able to regain its value, as according to the reports, UNICEF is considering adopting the cryptocurrency option to fight against COVID-19. In essence, this renowned global children charity is considering expanding its utilization of cryptocurrency to respond effectively to the donors’ demands and offer better support to different firms across the world.

Similarly, BTCS Inc. (A renowned blockchain firm) reported a 285% increment in the second quarter of 2020, due to its excellent time investment in both Ethereum and Bitcoin. The same company also crossed the mark of $1 million and is eyeing for future growth through its cryptocurrency holdings.

Moreover, experts believe that powered government can lead to enhanced adoption of Bitcoin post-COVID-19. In particular, considering the current outbreak situation, we are living in both decentralized and centralized worlds. Therefore, cryptocurrency gurus suggest that if the states are not able to act cohesively by adopting digital currencies, they are more likely to fail. In contrast, the remaining states will eventually become more centralized.

How COVID-19 has Impacted or may Impact Bitcoin Price

Since the COVID-19 outbreak, the correlation between equities and the Bitcoin market has significantly increased. Every Bitcoin enthusiast knows about March 12, 2020, when the Bitcoin price decreased below $4,000, as the USA’s S&P Index experienced a sharp decrease. The reason behind this was the sudden increase in liquidity. As a result, some investors suffered Equity margin calls that were needed to be covered by the liquidation of other assets, for instance, by converting BTC into cash.

Although Bitcoin’s market price has now been significantly recovered to a whopping $12,000, it will probably take some time until this cryptocurrency soars up again.

When Bitcoin‘s price reduced on March 12, the main reason behind this was the ignition of fear cultivating from other financial markets. The unique market structure of Bitcoin might be another reason that resulted in a significant drop in this cryptocurrency in the past.

According to the reports, the overall leverage level of the Bitcoin market is commonly significant. Still, during March 12 and 13, these levels became abnormally high, making them more vulnerable to a financial shock. This basically suggests that Bitcoin markets are highly self-correcting and resilient, even when there is a complete absence of foreign intervention. However, expert indicates that the frequent and continued utilization of leverage across the Bitcoin markets during the COVID-19 pandemic implies that the price of Bitcoin remains a threat to volatility spikes.

On the other hand, if you are a Bitcoin user, then it is time for you to rejoice because Bloomberg has forecasted that Bitcoin might reach its record peak of $20,000 to $28,000 this year. However, Bloomberg considers COVID-19 pandemic, and quantitative easing as the primary fuel that can drive the maturity of Bitcoin shortly, mainly when the stock market is crashing and the price of crude oil is reducing across the world.

Challenges Faced by Bitcoin During COVID-19 Pandemic

There is no doubt that Bitcoin technology was initially developed to give a competitive edge to the traditional currencies in the financial market. But, in the current world scenario, Bitcoin still faces hardships in terms of being adopted as a dominant currency, mostly because of the time it takes to confirm transactions.

Imagine purchasing an ice-cream, and standing there for 20-30 minutes so that the shopkeeper can accept and process your payment. Seems quite a bit odd, right? Due to this very reason, digital assets like Bitcoin are viewed as a significant financial debate.

Many believed that the COVID-19 pandemic was the best situation for Bitcoin to shine. The main reason behind this was the fact that Bitcoin is entirely unrelated to the rest of the global financial market, and therefore, can thoroughly act as a safe platform during the economic turmoil.

Still, why Bitcoin failed to live up to its promise? Many experts propose that one of the significant reasons behind Bitcoin’s failure in the initial period of the pandemic might be because of the wrong notion in the mind of the audience that Bitcoin can be used as a hedge during a recession. Secondly, the March 12 event spooked some of the investors and market makers that deals in cryptocurrency.

Thus, all the above-mentioned factors reflect that the COVID-19 period was quite challenging for the Bitcoin market, and this particular currency might require some time to rise again in the financial market.

Why Bitcoin can be an Attractive Investment Currency Post-COVID-19

The price of Bitcoin is evaluated by the belief which is instilled in it. Even after dropping significantly to 40 percent in terms of price, Bitcoin has recovered dramatically in recent weeks. In particular, at the time of writing, the cost of Bitcoin was equivalent to $12,009, which, if we compare to the previous price, i.e., $4,000 (the price of bitcoin on March 12) is quite significant.

Another important reason that may attract the interest of investors toward Bitcoin compared to other types of assets is that there are still many investors in the market that have not incorporated cryptocurrencies especially Bitcoins in their business portfolio.

Before the COVID-19 outbreak and the subsequent turmoil of the global economy, many financial bulls were already recommending a small cryptocurrency exposure within the investment portfolio. JPMorgan, for instance, wrote in one of their reports in February that the market of cryptocurrency is on the path of maturity, and there has been significant participation in terms of trading.

During the COVID-19 outbreak, the famous “Rich Dad and Poor Dad” author Robert Kiyosaki, recommended its followers that the value of the dollar is dying. Therefore, they should start considering investing in Bitcoin. Most recently, Michael Novogratz, the chairman of Galaxy Digital (a merchant bank for digital assets), suggested that the current financial situation can be an “amazing environment” for purchasing Bitcoin.

On the other hand, some cryptocurrency gurus also imply that considering the current COVID-19 situation, Bitcoin is still quite far from transforming into a haven like silver or gold for its potential customers.

Most importantly, the future of Bitcoin rests with the length of this ongoing COVID-19 pandemic. Who knows, the end of this grief-stricken crisis might bring a new ray of hope for this highly prominent cryptocurrency!

Final Thoughts

Remember, no hedge is perfect. The same thing is with Bitcoin. No doubt, Bitcoin has gone through a series of leaps or bounds during the worldwide COVID-19 pandemic. Still, cryptocurrency currency experts believe that Bitcoin can come back strong in the financial market.

What Bitcoin offers, is an investment option whose transferability, issuance, transparency, and design stand in stark contrast with other traditional systems of finances in the market. So what this cryptocurrency needs is a little bit of attention from investors. Once this is ensured, there will be no one to stop Bitcoin from demonstrating its capability to serve as a potential economic hedge throughout the globe.